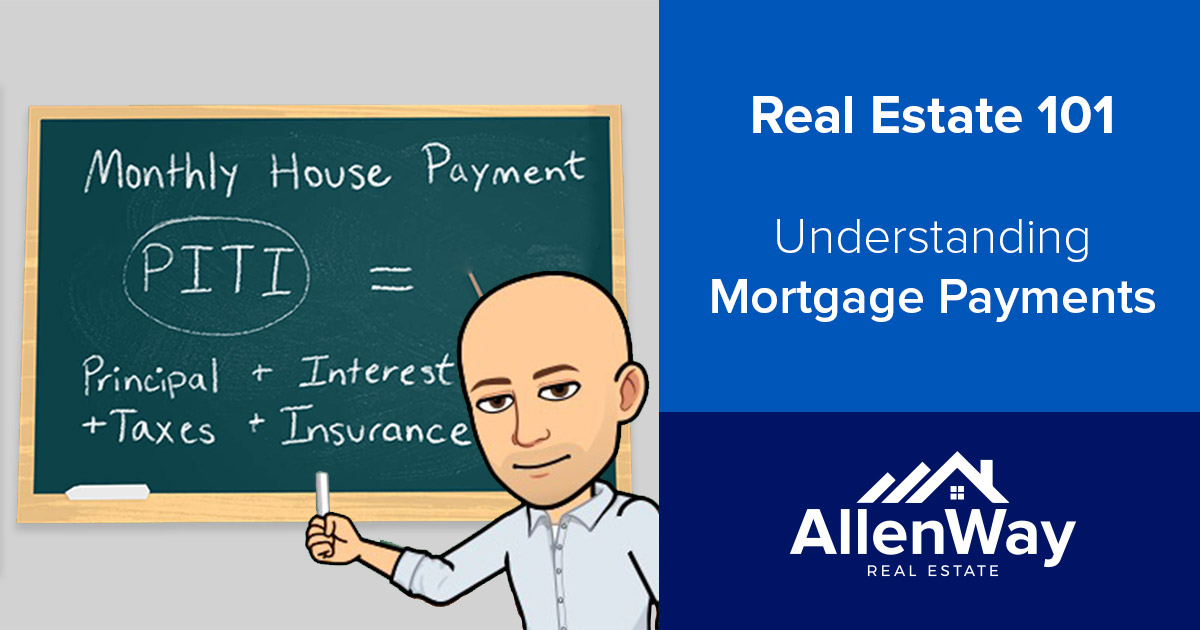

It is useful to find out what makes up NC recurring home loan payments to properly budget for home ownership costs. The acronym PITI is commonly used to represent the items, which are: principal, interest, taxes and insurance. All mortgages do not automatically include all of these. It can vary based on your specific mortgage.

What Makes Up Recurring Home Loan Payments

Principal Payments

Principal represents the balance of a loan. For a typical mortgage, a portion of the monthly payment is allocated towards lowering the balance, although there are exceptions. In the first several years of making payments, only a small portion of the payment will go towards principal, but this increases over time.

Interest

Interest is the amount billed by banks for use of money they lend. The interest rate is typically a yearly figure but billed in monthly increments calculated on the balance of a loan. Based on your type of loan, the rate will stay the same for the entire life of the mortgage or it can change at certain time frames.

Property Taxes

Taxes are levied by NC based on the assessed value of a property. The total is quoted annually but traditionally due in installments. Overdue property taxes become a lien on a property and take priority over mortgage liens. Many banks will, as a result, require borrowers to put aside money into an escrow account to ensure that there are sufficient funds for the bills when they are due. Funds are collected in monthly increments by the lender as part of the regular monthly payment. The lender then pays the taxes directly rather than waiting for the borrower to do so. It is a means of protecting their interests in a property.

Insurance

There are different types of insurance for a property. Homeowners is commonly a requirement whereas mortgage insurance depends on the specific loan. Both can be part of monthly mortgage payments.

Homeowners insurance protects against hazards such as fire. Mortgage companies mandate this insurance to protect the collateral on the loan. Insurance premiums are payable on an annual basis and many will require monthly contributions into escrow (similar to tax escrow). They will then submit payments to the insurance company directly to make sure the policy does not lapse.

Mortgage insurance is common for financing with low down payments. It protects the bank should a borrower fail to make payments. Lenders estimate that they will not recover the full amount owed to them if the property forecloses, so the mortgage insurance covers some of their loss. Although it protects the mortgage company, it is charged to the borrower.

Understanding NC Recurring Home Loan Payments

Not all loans are structured the same and therefore not all NC recurring home loan payments will contain each of the above items. There may be additional monthly expenses such as HOA fees, which are not escrowed by mortgage companies but are a significant factor in estimating total monthly housing expenses. Remember that final figures are determined by a specific property and interest rate, so any up-front estimates will likely fluctuate.